Investing in artificial intelligence (AI) stocks offers a unique opportunity for individual investors looking to tap into the growing influence of this technology. AI is rapidly changing industries, improving efficiencies, and creating new markets. With these opportunities come challenges that require careful consideration and research.

In this guide, you'll discover how to identify promising AI stocks, the key factors to consider before investing, and how to assess the long-term growth potential in this dynamic market. We’ll also address the risks associated with investing in AI stocks and provide strategies to stay informed about market changes. By the end, you’ll have a better understanding of how to diversify your portfolio with AI investments and make informed decisions that could lead to financial freedom.

How to Spot Winning AI Stocks and What to Look For

To find the best AI stocks, start by familiarizing yourself with the current market landscape. This means understanding major players, trends, and technologies driving growth. Look for companies with solid business models and innovative products that stand out from their competitors.

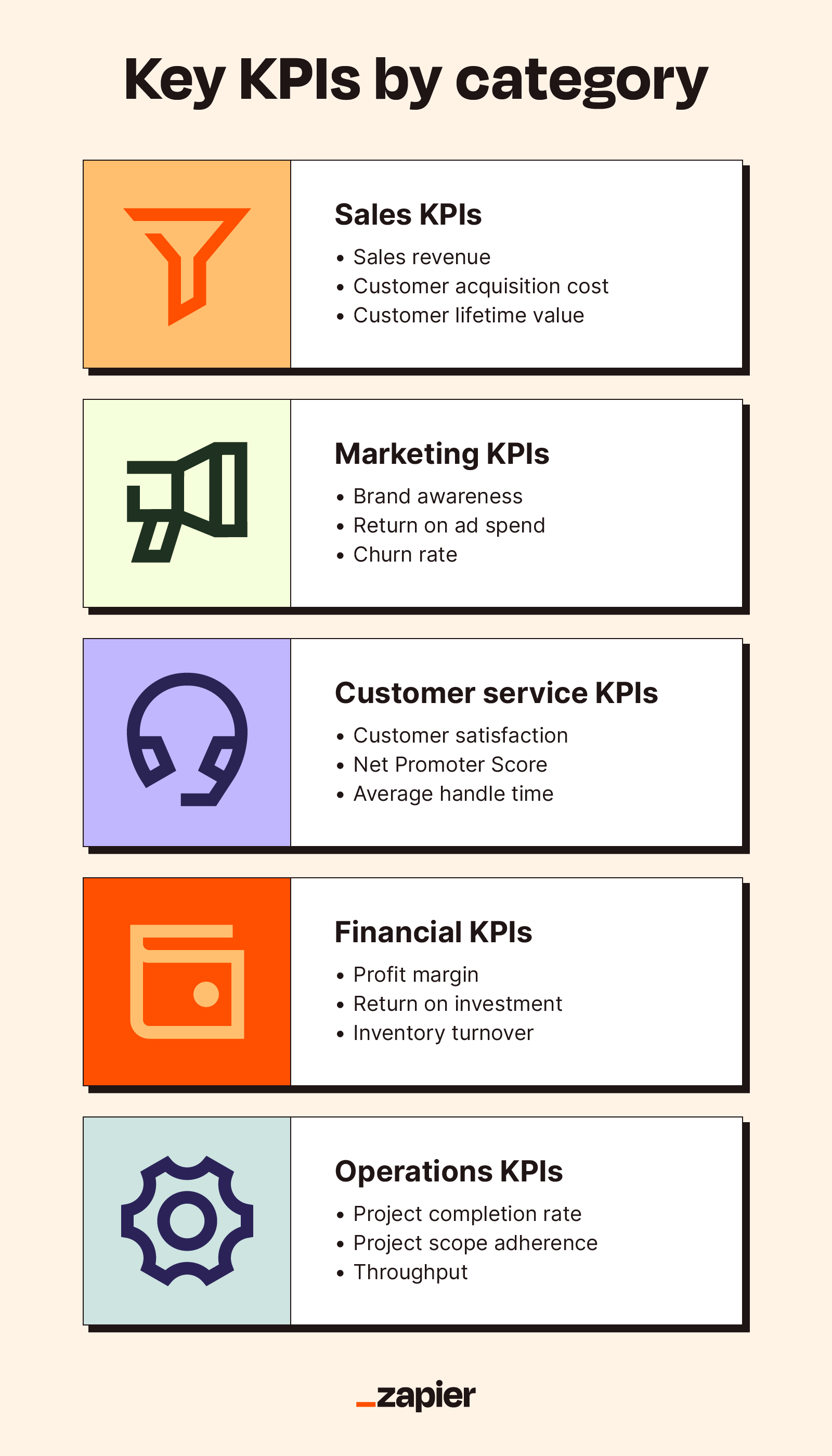

Assess how well a company’s products meet market needs and consider its long-term growth potential. Research indicates that the global AI market is anticipated to expand from $214.6 billion in 2024 to $1,339.1 billion by 2030, growing at a CAGR of 35.7% according to Grand View Research. Identifying companies well-positioned to benefit from this trend can significantly enhance your investment strategy.

This graphic illustrates the projected growth trajectory of the U.S. artificial intelligence market (Source: Grand View Research)

Essential Considerations Before You Buy AI Stocks

Before diving into buying AI stocks, it's crucial to evaluate several key factors. Start with the company’s financial health: examine their profit margins, revenue streams, and balance sheets. Understanding the management team is also vital. Their experience and technological expertise can directly influence the company’s performance in this fast-evolving sector.

Market conditions can be unpredictable, and AI stocks can be particularly volatile. The emergence of startups like DeepSeek has created significant shifts in the industry landscape, affecting established players like Nvidia. Recognizing these influences can be essential to making informed decisions.

This chart summarizes key performance indicators relevant to evaluating AI stocks (Source: CTF Assets)

This chart summarizes key performance indicators relevant to evaluating AI stocks (Source: CTF Assets)

Long-Term Growth and Performance Assessment in AI Stocks

When assessing AI stocks, pay close attention to long-term growth projections. Look for trends in revenue forecasts, such as reports indicating that AI industry revenues are expected to grow 15-fold from 2022 to 2027, moving from $28 billion to $420 billion.

Focusing on how a company plans to monetize its technology is crucial. Good indicators of success are strong revenue growth, effective management of costs, and a clear strategy for scaling innovations. For example, sectors like healthcare and fintech are rapidly integrating AI solutions, creating significant investment opportunities.

This line graph showcases revenue growth projections for AI companies over the next decade (Source: Omdia)

This line graph showcases revenue growth projections for AI companies over the next decade (Source: Omdia)

Understanding the Risks of Investing in AI Stocks

Investing in AI stocks involves several inherent risks. Market volatility is prominent; for instance, Nvidia experienced a sharp drop in value due to regulatory concerns. Such fluctuations can influence investor sentiment and stock prices dramatically.

Additionally, ethical considerations surrounding AI usage are becoming increasingly important. Regulatory changes can also present challenges for companies operating in the AI space. To mitigate these risks, consider diversifying your investment portfolio. Spreading your investments across different industries can help buffer against significant losses from any single stock.

A visual depiction of market trends and risks associated with AI stocks (Source: The New York Times)

A visual depiction of market trends and risks associated with AI stocks (Source: The New York Times)

Stay Ahead: Keeping Up with AI Market Trends

Staying informed about market trends is critical for success as an AI investor. Utilize reliable financial news outlets and subscribe to newsletters focusing on AI developments. Building connections with fellow investors can also provide valuable insights into market changes.

As regulatory environments continue to evolve, staying abreast of legislative changes can help you anticipate market shifts. This proactive approach is essential for navigating the fast-paced AI investment landscape.

A screenshot that highlights current AI stock updates, showing real-time market changes (Source: The New York Times)

A screenshot that highlights current AI stock updates, showing real-time market changes (Source: The New York Times)

The Transformative Impact of AI on Traditional Industries

AI technology is reshaping several traditional industries, particularly healthcare and finance. Innovations such as predictive analytics and machine learning are enhancing operational efficiency and customer relations.

For example, as generative AI becomes more prevalent in healthcare, it’s poised to change how clinical decisions are made. Companies that focus on these transformative tools represent significant investment prospects as demand for these solutions grows.

This comparison illustrates traditional industry practices versus AI-enhanced methodologies (Source: ResearchGate)

This comparison illustrates traditional industry practices versus AI-enhanced methodologies (Source: ResearchGate)

Diversifying Your Portfolio with AI Investments

Diversifying your investment portfolio is a vital strategy when investing in AI stocks. To mitigate risks, consider limiting your exposure to any single stock, ideally not exceeding 10% of your overall portfolio. A balanced portfolio should also include traditional assets to stabilize returns during volatile periods.

Investing across various sectors using AI technologies can buffer against potential downturns in specific markets while maximizing growth potential.

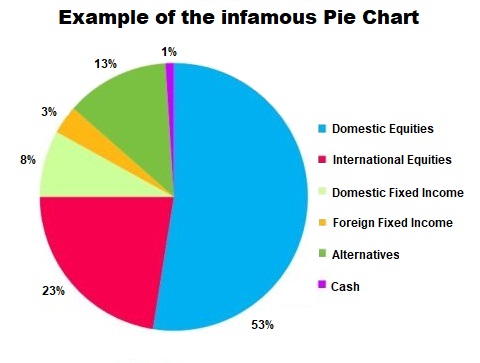

A pie chart illustrating a diversified investment portfolio layout (Source: RFS Advisors)

A pie chart illustrating a diversified investment portfolio layout (Source: RFS Advisors)

Key Performance Indicators for Evaluating AI Stocks

To effectively evaluate AI stocks, focus on specific financial metrics such as revenue growth, research and development spending, and net income margins. Additionally, consider qualitative aspects like innovation potential and competitive positioning.

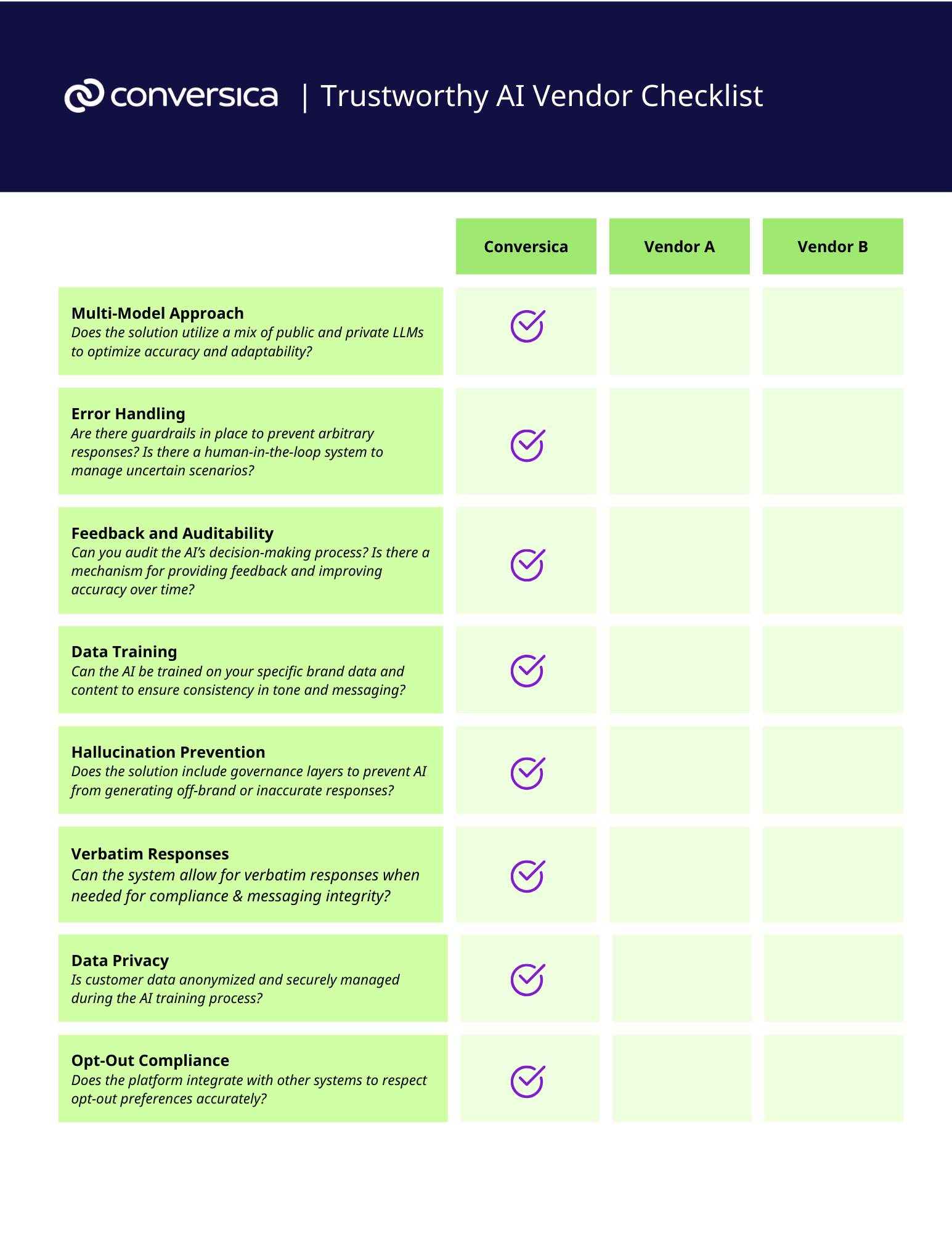

Creating a checklist of performance indicators will help you assess whether a stock aligns with your investment objectives and risk profile. Strong governance and a well-defined strategy for AI deployment can also indicate a company’s potential for sustained success.

A checklist graphic highlighting essential AI stock KPIs (Source: Conversica)

A checklist graphic highlighting essential AI stock KPIs (Source: Conversica)

Navigating AI Investments: Finding Balance with Other Assets

Balancing your AI investments with other asset types is essential for long-term financial health. Your strategy should consider various asset classes based on your risk tolerance and investment goals.

Reviewing your portfolio regularly and adjusting your asset allocation can help you maintain a balanced approach that embraces the potential of AI while safeguarding against risks associated with market downturns.

A bar graph that illustrates the risk versus return profiles of different asset classes (Source: Visual Capitalist)

A bar graph that illustrates the risk versus return profiles of different asset classes (Source: Visual Capitalist)

Conclusion

Investing in AI stocks can be rewarding when grounded in diligent research and a strategic mindset. By gaining a clear understanding of the AI landscape, recognizing regulatory impacts, and evaluating risks, you can better position yourself to benefit from growth opportunities in this dynamic field.

Remain vigilant about emerging trends, embrace diversification, and track key performance indicators to optimize your investment portfolio. With the right approach, you can navigate the complexities of AI investing and work towards achieving financial freedom.

Komentar (0)

Masuk untuk berpartisipasi dalam diskusi atau .